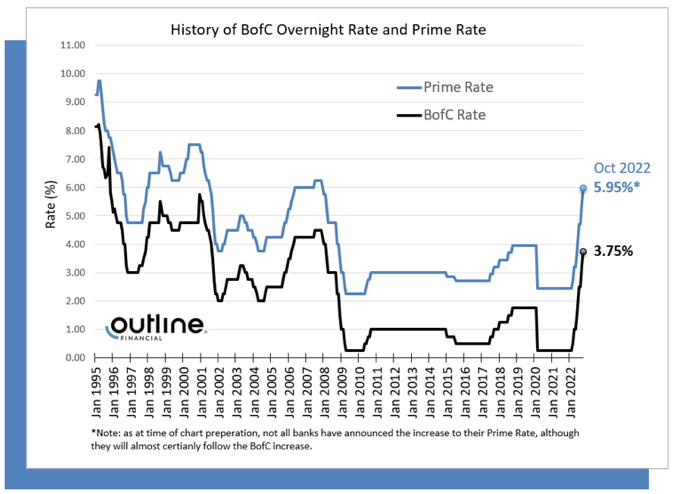

The Bank of Canada raised its overnight target rate by 0.50% (50 basis points) today, bringing it to 3.75%. This was a smaller rate hike than what many economists were projecting (expecting 0.75% hike).

While we have included our full commentary https://www.bankofcanada.ca/2022/10/fad-press-release-2022-10-26/, In summary, the Bank of Canada said interest rates need to rise further to “restore price stability” for Canadians, and that future moves will be data dependent. “Further rate increases will be influenced by our assessments of how tighter monetary policy is working to slow demand, how supply challenges are resolving, and how inflation and inflation expectations are responding,” the Bank said in its statement accompanying the decision.

The next Bank of Canada meeting is December 7th. As at the time of writing, many banks/economists anticipate that after one more increase in December, the overnight rate will remain flat during 2023 and begin a slow descent back to the 3.0% range by the end of 2024.

Banks and other financial institutions are expected to increase their Prime Lending rate in the coming days (rising from 5.45% to 5.95%) which directly impacts variable-rate mortgage holders. We were also notified earlier this week that some lenders may be increasing their fixed rates given the rise in bond yields earlier this month, although this could change as bond yields decreased today given the lower than anticipated increase by the BofC.

For clients with variable rates currently, strategies to stay variable vs. converting to fixed should be analysed individually as each situation and variable rate product is unique.

Clients considering a pre-approval or refinance should book a rate hold as soon as possible to protect themselves from volatility.

Stress Test and Variable Rate Pre-Approvals

- Stress Test Reminder: To help ensure clients can absorb interest rate shocks, all banks and federally regulated lenders are required to qualify clients’ based on a “Stress Test” interest rate set at the greater of 5.25% or the clients’ actual mortgage rate +2.00%.

- Why does this matter? After the recent Bank of Canada increase, the stress test rate has increased for variable rate mortgages which will reduce a clients’ borrowing/purchasing power (rule of thumb: each 0.5% increase in the stress test rate is equivalent to an approx. 4% reduction in borrowing/purchasing power). If you have an existing variable rate pre-approval, or would like to secure a pre-approval, please contact a member of the Outline Financial team so we can help quantify the impact of this change.