In these tumultuous times, and as a new year is set to begin, people are wondering what to expect with the real estate market in the near future. And while no one has a crystal ball, experts are making predictions about what we could see for real estate in 2023. Here’s what they’re saying.

“Looking forward, we anticipate housing demand to remain at or near the bottom this winter until we get clarity from the Bank of Canada regarding the end of the current tightening cycle, which should bring some well-qualified buyers off the sidelines. That likely sets up a modest rebound in demand come the spring, but it’s difficult to envision a return to the frothy market of late 2021 and early 2022. The unknown and all-important variable becomes supply, and there’s a case to be made that we’ll also start to see an increase in listing activity as the impact of high rates, a strong flow of new housing completions, and deteriorating employment trends work their way through the market.” Olena Vus, Outline Financial

Canadian home prices could continue to drop…

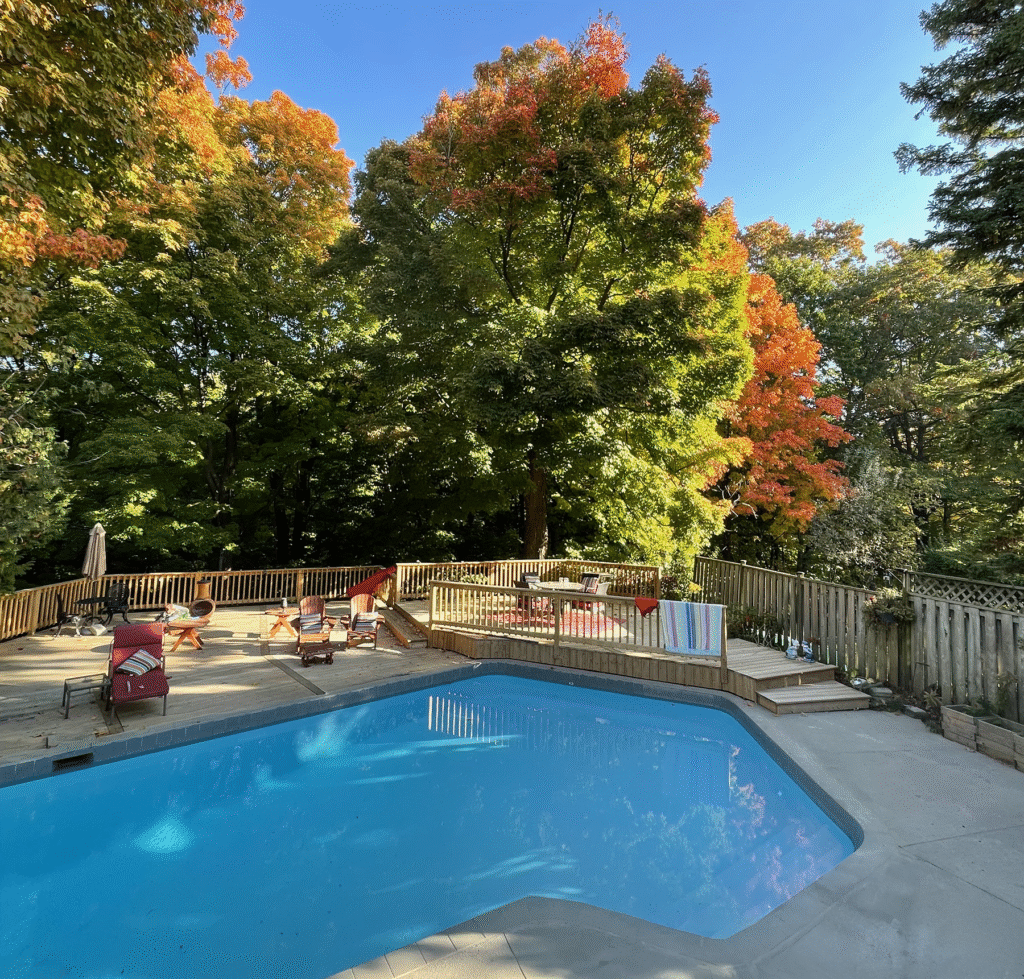

Canada’s housing market reached an all-time high in February 2022, largely due to historically low interest rates and demand from pandemic living. Now that the Bank of Canada has increased rates steadily—with additional rate hikes likely still to come—we’ve seen an adjustment in the number of homes for sale, and the average sales growth has slowed.

Experts are now predicting steeper price declines in early 2023 than they did originally. TD Economics predicts the average national home prices will drop by 11%, while Desjardins predicts an average 23% decrease in the average home price from the height in February 2022 to next December 2023.

“In like a lamb and out like a lion; that’s 2023. We’re going to see more downturn certainly more hesitation in the market and there absolutely will be some spectacular deals to be had.” – Rick DeClute, Broker

…but that doesn’t mean they’ll be more affordable

However, while home prices may drop, that doesn’t mean they’ll be more affordable—buyers will have to factor in higher mortgage rates. Housing supply could also diminish as people decide to hold off on selling, which could keep prices competitive, especially in Toronto.

“Affordability certainly needs to work into the equation, but at the end of the day people want to own real estate and they want to own it in toronto.” – Rick DeClute, Broker

The market should rebound in 2024

While experts are predicting a downturn in real estate in 2023, they’re already looking ahead to an upswing in 2024. TD Economics predicts a rebound of 19% in 2024, and Desjardins claims that at the end of 2023, home prices will settle in above their pre-pandemic levels nationally and provincially.

“At the end of the day the the most relevant fundamental in Toronto real estate is demand. That is not changing, and if anything it is only becoming more relevant.” – Rick DeClute, Broker

Rent prices will continue to increase

In response to the volatile real estate market for buying and selling, rentals are in demand in Toronto. This is driving up the cost—in October, average rental prices grew 27% year over year—and this will likely continue into early 2023.