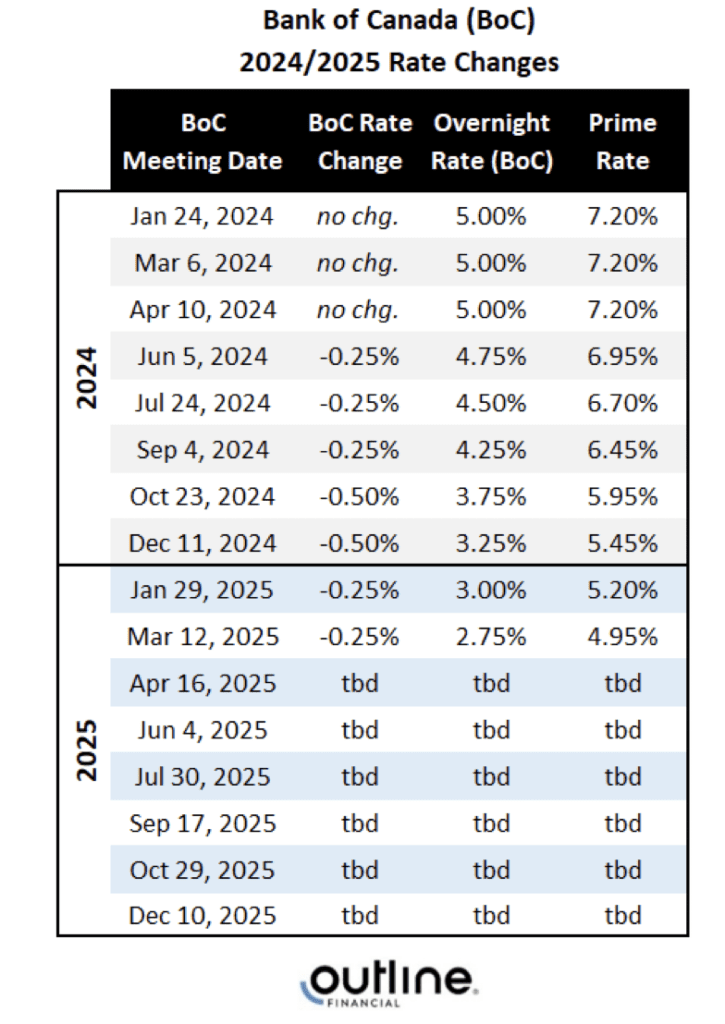

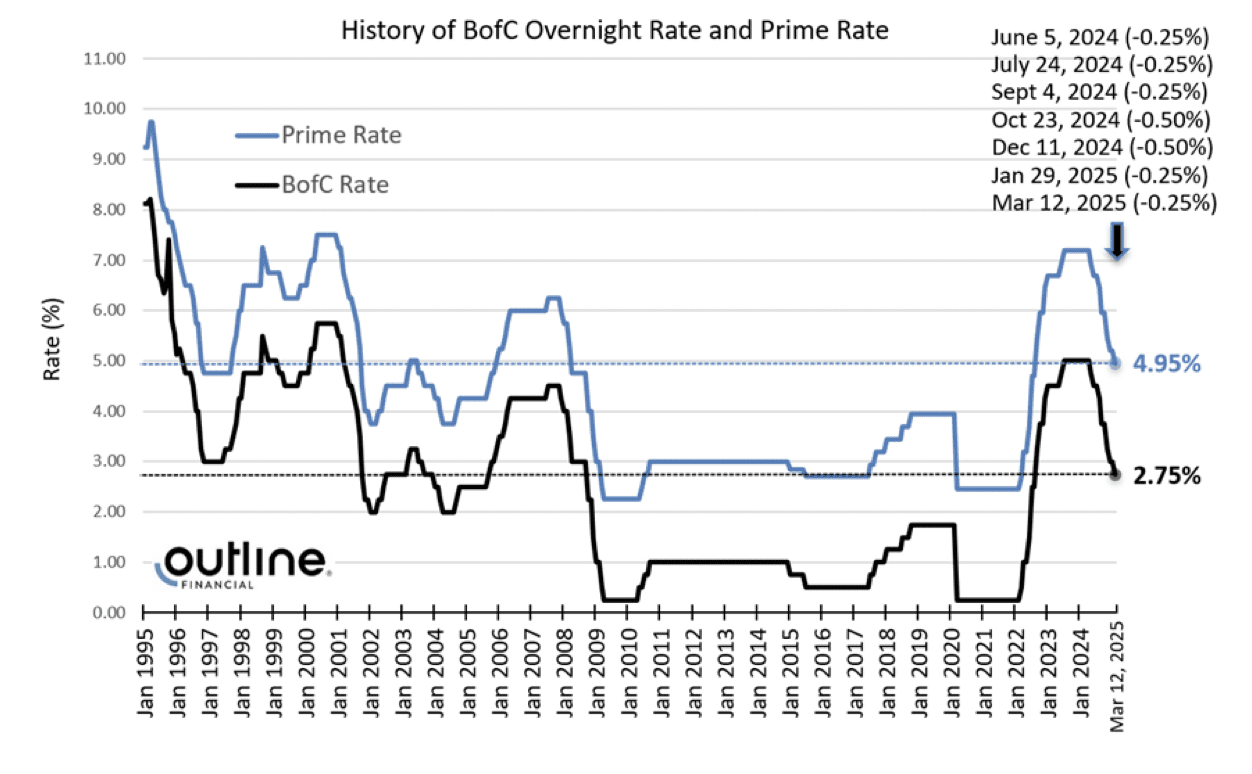

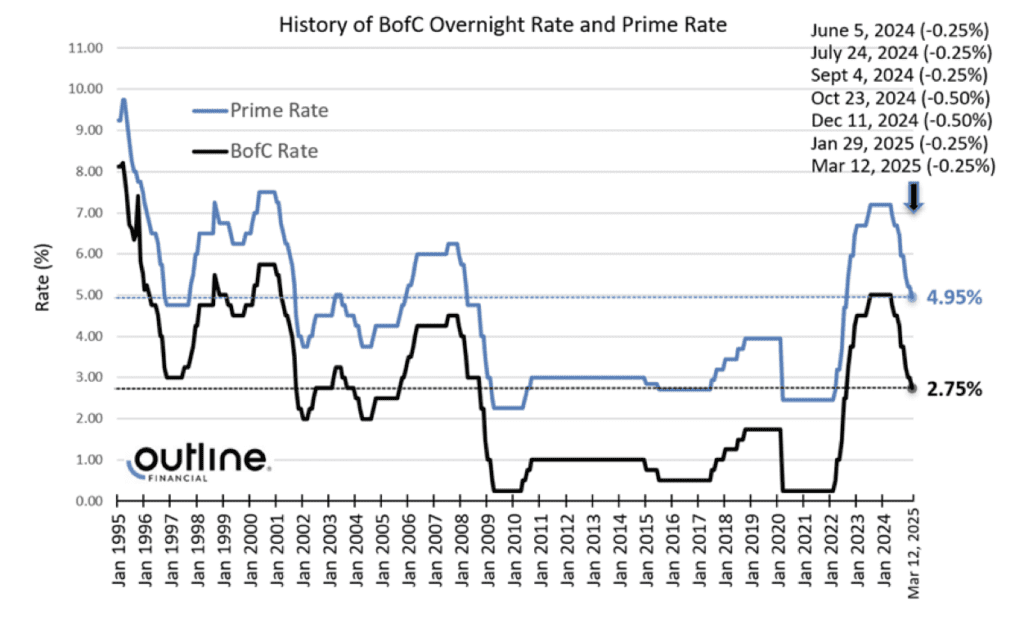

On March 12th, as widely expected, the Bank of Canada announced a further 0.25% reduction in its overnight rate. This brings the overnight rate down to 2.75% and the prime rate down to 4.95%. After 225 basis points of cumulative rate cuts (-2.25%) since June 2024, the overnight rate and prime rate are at their lowest point since August 2022.

Why did the Bank of Canada lower rates, and what could be next? To help answer those questions and more, we’ve included some helpful links below, as well as an “in their words” summary of the Bank of Canada’s March 12th statement below.

Bank of Canada Links/Publications:

- Bank of Canada, March 12th press release [Click Here]

- Bank of Canada, March 12th the press conference [Click Here]

- Opening statement: Tiff Macklem (Governor of the Bank of Canada) [Click Here]

Why did the Bank of Canada decide to continue reducing rates (in their words)?

- “We ended 2024 on a solid economic footing. But we’re now facing a new crisis. Depending on the extent and duration of new US tariffs, the economic impact could be severe. The uncertainty alone is already causing harm.” – Tiff Macklem opening statement

- “Recent surveys suggest a sharp drop in consumer confidence and a slowdown in business spending as companies postpone or cancel investments.” – BofC press release

- “Against this background, and with inflation close to the 2% target, Governing Council decided to reduce the policy rate by a further 25 basis points.” – BofC press release

What’s Next for The Bank of Canada (in their words)?

- “Monetary policy cannot offset the impacts of a trade war. What it can and must do is ensure that higher prices do not lead to ongoing inflation.” BofC press release

- “Looking ahead, the trade conflict with the United States can be expected to weigh on economic activity, while also increasing prices and inflation. Governing Council will proceed carefully with any further changes to our policy rate given the need to assess both the upward pressures on inflation from higher costs and the downward pressures from weaker demand.” – Tiff Macklem opening statement

Are Additional Rate Cuts Expected? While the Bank of Canada does not provide rate forecasts, at the time of writing this email, most big banks and economists are forecasting a further 0.25% to 0.75% of rate cuts during 2025 bringing the overnight rate to between 2.00% to 2.50% (Prime rate to 4.20% to 4.70%). As these forecasts can change significantly and regularly, please reach out at any time for the most up-to-date information and potential strategies.

Chart of Historical Overnight & Prime Rates:

Chart of Historical Bank of Canada Rate Decisions and Upcoming Meeting Dates: